HomePrep is a Technology Solution That Connects Mortgage Loan Originators

With Clients on Their Path to Mortgage Readiness, To HUD Counselors That Help Them Achieve It!

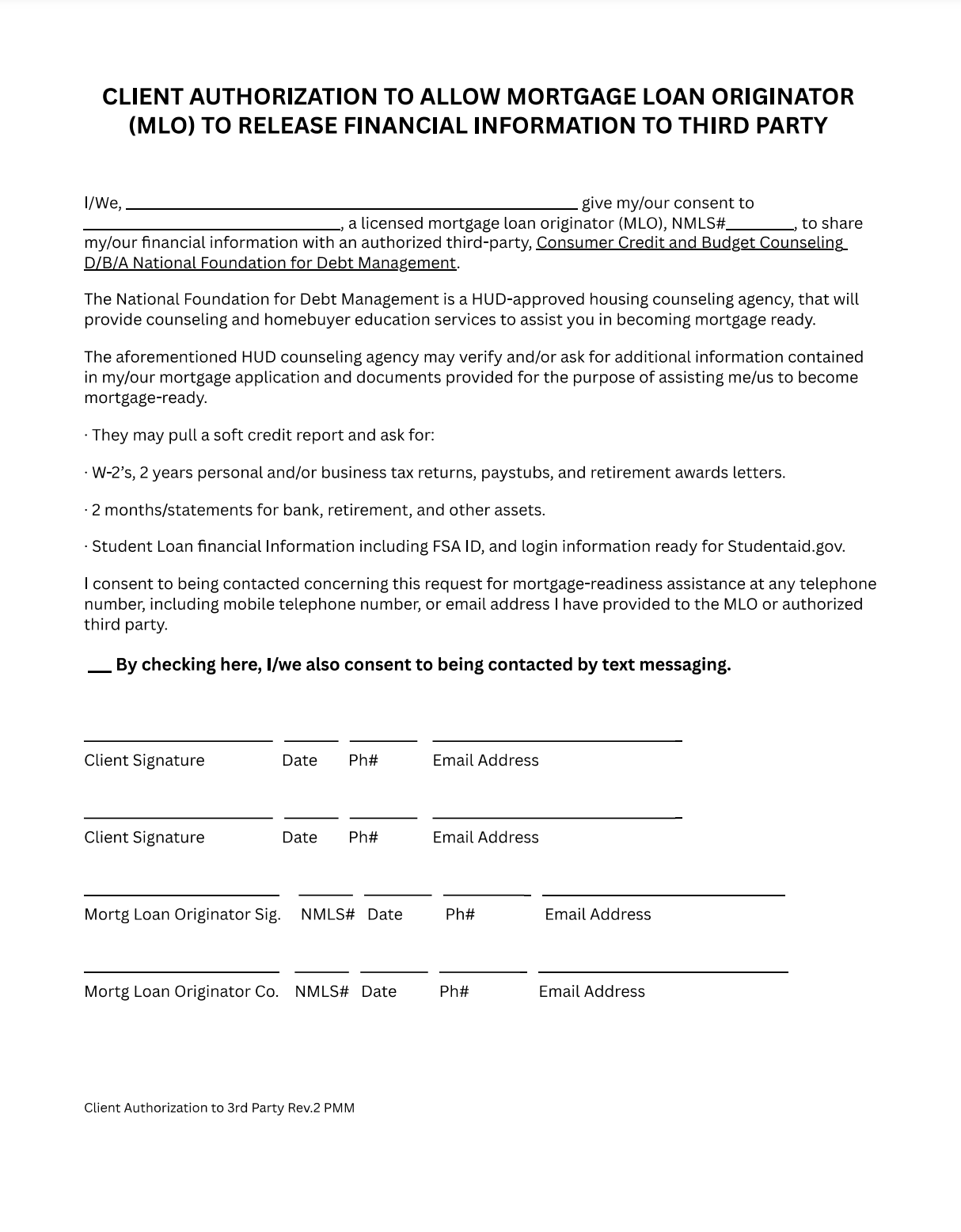

The connection between MLO's and HUD counselors is made possible by Indisoft, a national mortgage software company.

National Foundation for Debt Management, a national non-profit HUD housing and credit counseling agency, is the initial pilot HUD counseling agency of HomePrep.