Equal Housing Lender

Independent MLO Workshop

Navigating DPA Mortgages & 2 Origination Paths

Event Title and Details:

Title: Independent MLO Workshop: Navigating DPA Mortgages & 2 Origination Paths

Date: September 20th, 2023

Time: 11:00 AM to 12:00 PM

Location: Online Webinar

For every unique housing market, there is always a client need that bubbles to the top. Independent licensed loan originators, or mortgage brokers, are positioned to handle this opportunity the best because this group of mortgage professionals are able to seek out specialized loan programs that can solve problems and add them to their portfolio.

In today’s unique mortgage market, independent loan originators are poised to offer the “most and best” down payment assistance, but only if they know how to harness hundreds of options in states they are licensed in and filter out options unique to their client’s needs.

Today you will learn how independent loan originators have a distinct advantage to provide down payment assistance with multiple options unavailable to retail loan originators. .

4 DPA Options Available to Independent Loan Originators

Licensed independent loan originators can use wholesale lenders who provide or allow these varieties of down payment assistance:

- 1st mortgage and 2nd DPA combined financing where both programs are originated and underwritten at one wholesaler.

- 1st mortgage wholesalers that allow outside DPA 2nd mortgages like Florida SHIP to be added to the 1st mortgage.

- State DPA programs in Florida and some other states are offered through wholesalers.

- Unique DPA Program Providers, such as HUD housing counseling agencies, can offer specialty DPA for needs such as renovation.

1st mortgage combined with 2nd mortgage DPA:

- Land Home Financial Services

- Orion Lending

- AFR

- EquityPrime

Wholesale lenders that allow DPA (ie. Fl SHIP) to be added to originated 1st mortgage:

- UWM (has list of already approved DPA 2nd mortgage providers!)

- PennyMac

- Kind Lending

- Keystone Funding

- Windsor

- Cardinal Financial

Wholesalers that provide FL FHFC Hometown Heroes, Bond and TBA Products

- UWM (Hometown Heroes)

- Windsor Mortgage (Hometown Heroes, Bond, TBA)

- FBC

Unique DPA Program Providers

- Solita's House: Conv only, Fl. statewide, renovation available. No income cap.

When state, county and city DPA funds run out, wholesale lenders can still provide DPA products for independent loan originators.

Two Options for MLOs to Originate Down Payment Assistance Loans

Finding the right DPA program is a HUGE task. But there are 2 options that MLOs have available:

1. A tool where all of the information you need is at your fingertips, constantly updated, and accessible anytime.

2. A HUD counselor that uses the tool and can find DPA options for your client for you.

Ready to take advantage of DPA?

Slide 1 below: Down Payment Connect for MLO's & Realtors:Reources and Tools In Down Payment Connect (DPC)

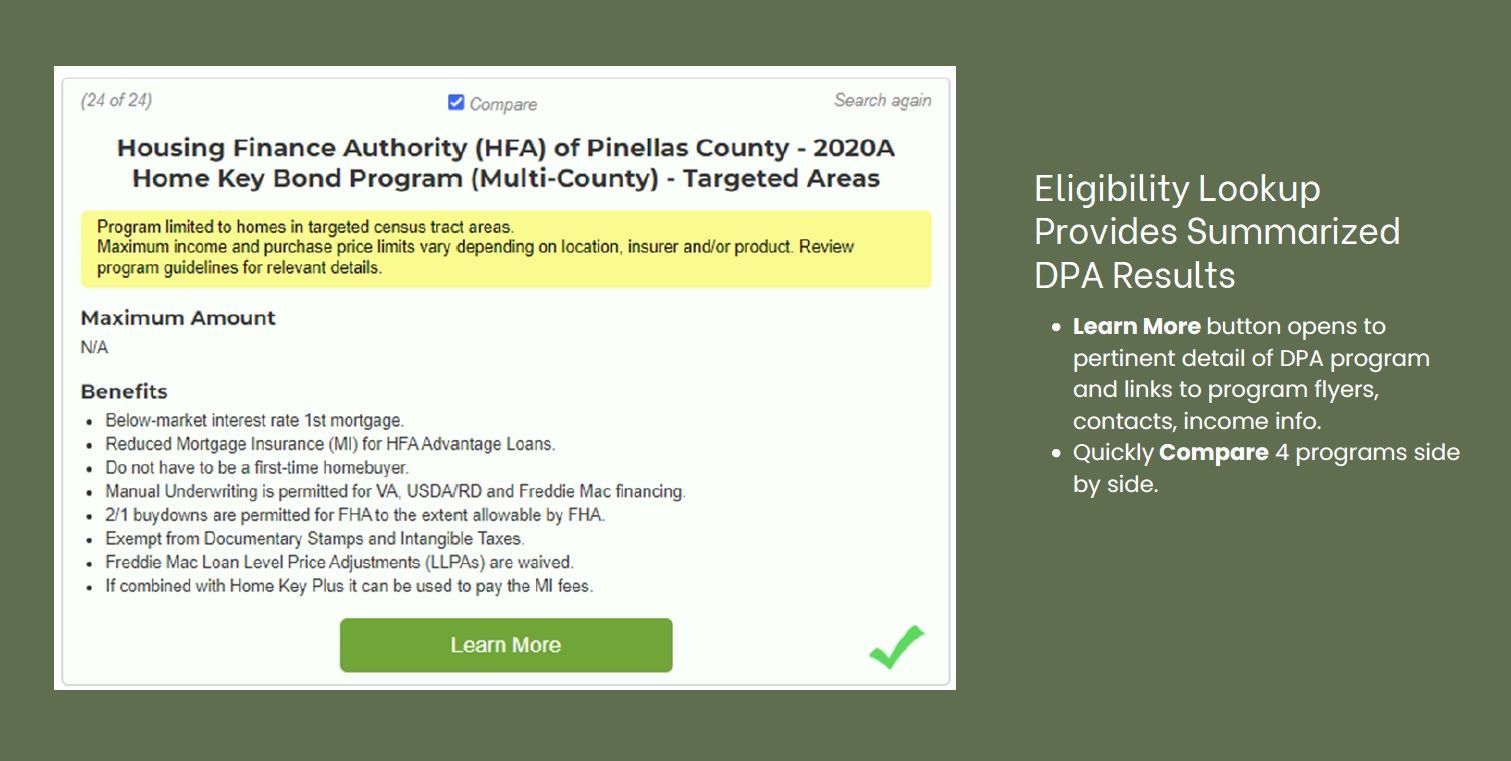

Slide 2 below: Eligibility Lookup Provides Summarized DPA Results in DPC

Slide 3 below: Side by Side Comparison of 4 DPA Programs at a time in DPC (+tips to delete programs not needed)

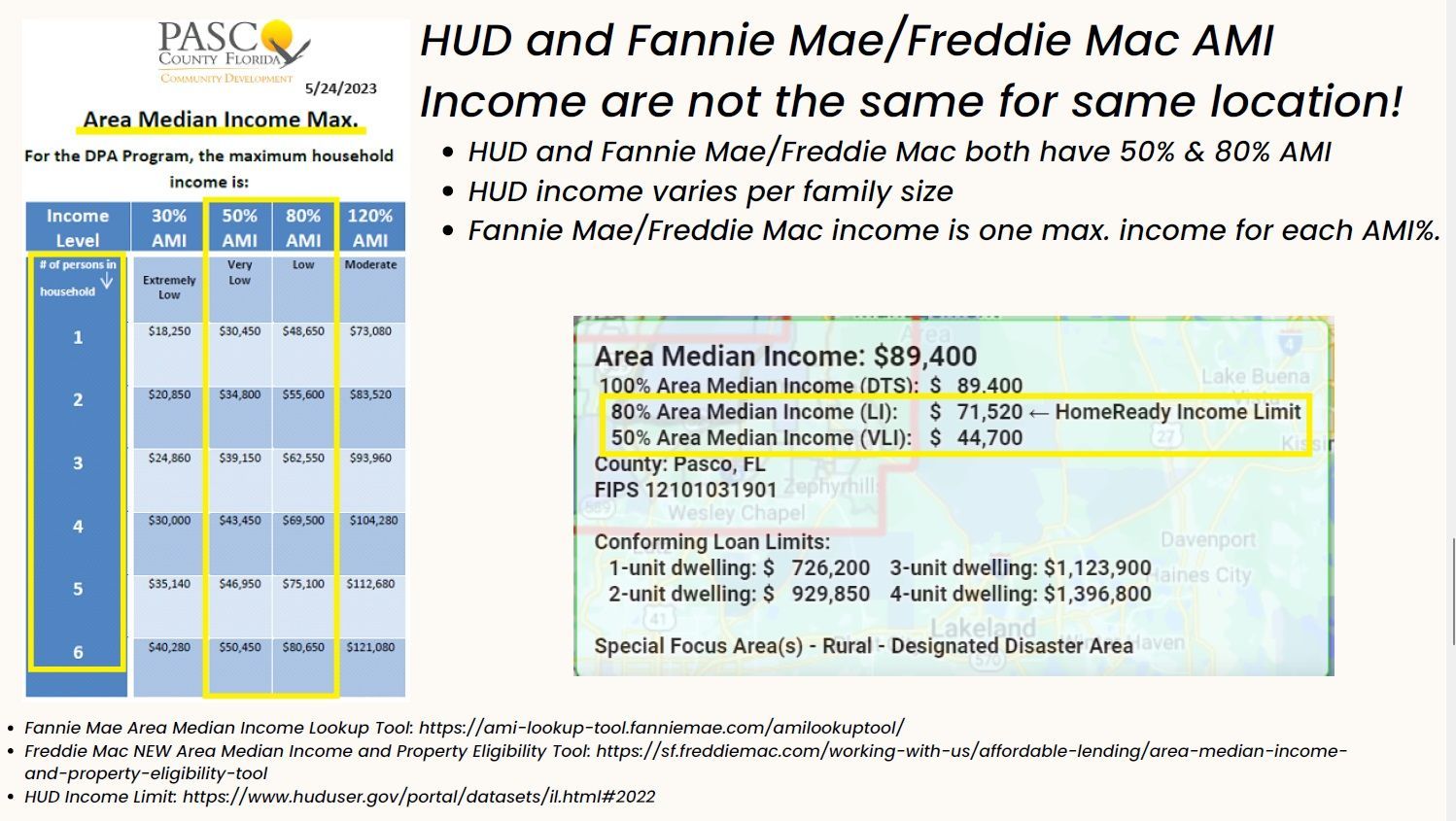

Slide 4 below: HUD and Fannie Mae/Freddie Mac AMI incomes ARE NOT THE SAME!

Moderators

Pam Marron

Licensed Loan Originator, NMLS 246438

Innovative Mortg Svcs Inc., NMLS 250769

Mobile: 727-534-3445

Email: pam.m.marron@gmail.com

Website: CloseWithPamandTara.com

Andrew Kashella

Sr. VP/Chief Tech Officer, NMLS 139171

Innovative Mortg Svcs Inc., NMLS 250769

Mobile: 727-222-4575

Email: Andrew@InnovativeMLO.com

Website: InnovativeMLO.com

Daniel Hughes

Mortgage Broker, NMLS-1457383

Owner, BayPort Lending, NMLS 2104798

Mobile (941) 243-4117

Email: Daniel@Bayportlending.com

Website: BayPortLending.com

HomePrep has 6 Services

1.Today we are concentrating on DPA help that the HUD counselor can provide YOU, the MLO, for your client but the client can also get help with:

2.Credit, short term (1-6mos) and long term (7mos to 5 yrs) using CreditXpert tools Wayfinder and What If Simulator.

3.Student Loan Repayment help! November 15th Brokers and Bagels webinar will be all about this truly incredible platform that can help clients have manageable student loan payments so that a home putrchase is possible! Additional $99 for this service.

4.Budgeting

5.Online Homebuyer Education class for DPA, Affordable products

6.The final piece to getting your client mortgage ready: HUD counselor pulls FHLMC AUS with a soft pull credit and provides to you. (Government Sponsored Enterprises (GSEs) Mortgage-Readiness Assessment Tools)

HomePrep Pilot is in need of 10 loan originators who have clients in need of DPA!

- Client will pay $99 to HUD counselor for DPA and still receive other HomePrep services (other than Student Loan Repayment plan which is additional $99).

- MLO will not be charged HomePrep Technology costs (yearly subscription and $/per case) for the 1st 30 days.

- If you are an MLO that would like to be in the HomePrep pilot for DPA, contact Pam Marron at 727-534-3445 or email pam.m.marron@gmail.com.

Upcoming Brokers and Bagels

- Oct. 18th Brokers and Bagels: Introducing Home Prep!

- Nov. 15th Brokers and Bagels: HomePrep Student Loan Repayment Plans

- Dec. 20th Brokers and Bagels: All about Accessory Dwelling Units (ADU)