Equal Housing Lender

DIY Student Loan Help for Clients

Loan originators can offer Student Debt Solutions (SDS) as an "MLO DIY Solution" for clients OR utilize HUD counselors that use SDS through HomePrep!

Click here to view video.

Loan originators working with clients who have student loans are facing new credit challenges and payment constraints that may impact a prospective homebuyer’s ability to qualify for a mortgage. Understanding these issues and the available solutions can help MLOs better guide their clients through the home financing process.

How to Use Student Debt Solutions

MLO DIY Solution

MLO's can refer clients directly to Student Debt Solutions for repayment plans and default resolution. There is no cost to go all the way through to seeing plans client is eligible for! A cost is only incurred if the client would like to implement a new plan through SDS.

HomePrep for MLOs

Student Debt Solutions is also available for clients that go through HomePrep.

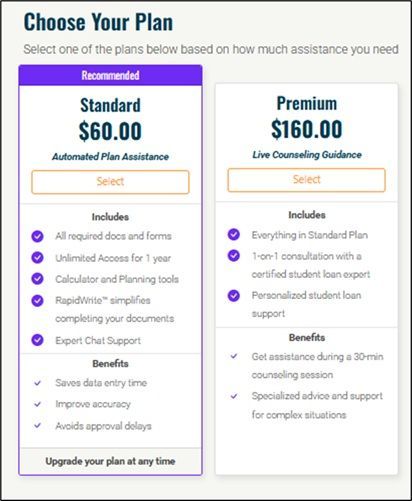

Note: a special discount is already applied for clients through MLO DIY Solutions or HomePrep for MLOs.

Disclaimer: Ms. Marron, Clients2Homeowners.com website developer, receives no compensation for the SDS service or any other services promoted on this site.

The Best Page on SDS for MLOs & Clients to view!

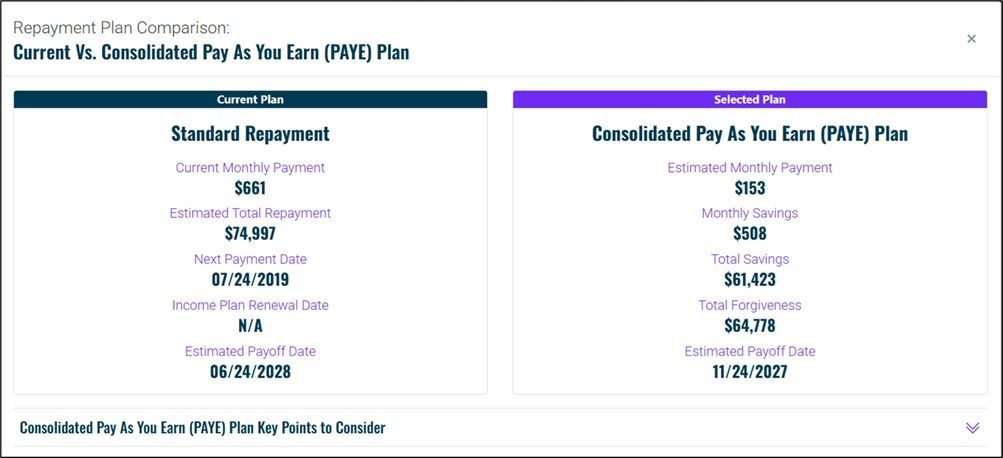

The Repayment Plan Comparison on SDS shows the current payment next to the selected plan payment, and the monthly savings below. This is the page you may suggest your client get a screenshot of and provide to you!

Loan originators can take that lower payment, put it into debt in your LOS and calculate how much more home your client can qualify for. In this case, the $508 savings equates to $75,000 more in the loan amount and buying power!

Unlock Your client's Homeownership Dreams

Student Debt Solutions: A DIY Solution for Mortgage Clients with Student Loans

Understanding Mortgage Underwriting Guidelines

Navigating the complexities of mortgage underwriting can be challenging. Here’s a breakdown of the guidelines for FHA, Fannie Mae, Freddie Mac, VA, and USDA loans, especially in various payment scenarios.

Fannie Mae Guidelines

https://selling-guide.fanniemae.com/sel/b3-6-05/monthly-debt-obligations#P3441

If a monthly student loan payment is provided on the credit report, the lender may use that amount for qualifying purposes. If the credit report does not reflect the correct monthly payment, the lender may use the monthly payment that is on the student loan documentation (the most recent student loan statement) to qualify the borrower.

If the credit report does not provide a monthly payment for the student loan, or if the credit report shows $0 as the monthly payment, the lender must determine the qualifying monthly payment using one of the options below.

If the borrower is on an income-driven payment plan, the lender may obtain student loan documentation to verify the actual monthly payment is $0. The lender may then qualify the borrower with a $0 payment.

For deferred loans or loans in forbearance, the lender may calculate.

- a payment equal to 1% of the outstanding student loan balance (even if this amount is lower than the actual fully amortizing payment), or

- a fully amortizing payment using the documented loan repayment terms.

Freddie Mac Guidelines

https://guide.freddiemac.com/app/guide/section/5401.2

Student loans in deferment, forbearance or repayment, including income-driven repayment plans

In all cases, an amount greater than zero must be included in the monthly DTI ratio for all student loans, as described below:

- If the monthly payment amount reported on the credit report is greater than zero, the Seller must use the amount reported on the credit report, unless other documentation in the Mortgage file supports a different current payment amount greater than zero, or

If the monthly payment amount reported on the credit report is zero, the Seller must use 0.5% of the outstanding loan balance, as reported on the credit report, unless other documentation in the Mortgage file supports a different current payment amount greater than zero

For student loans in income-driven repayment plans when documentation in the Mortgage file indicates the Borrower must recertify their income and/or that the Borrower’s payment will increase prior to or on the first Mortgage payment due date, the Seller may not use the monthly payment amount described above in the DTI ratio and must instead use:

- The greater of the current payment or 0.5% of the outstanding loan balance, or

- The documented future payment amount if greater than the current payment, or

- The future payment amount that is less than or equal to the current payment, provided that the Mortgage file contains documentation that the Borrower has recertified their income and the future payment amount has been approved. The future payment amount must be greater than zero.

FHA Guidelines

https://www.hud.gov/sites/dfiles/OCHCO/documents/2021-13hsgml.pdf

For outstanding Student Loans, regardless of payment status, the Mortgagee must use:

- the payment amount reported on the credit report or the actual documented payment, when the payment amount is above zero; or

- 0.5 percent of the outstanding loan balance, when the monthly payment reported on the Borrower’s credit report is zero.

VA Guidelines

https://www.benefits.va.gov/HOMELOANS/documents/circulars/26_17_23.pdf

a. If the Veteran or other borrower provides written evidence that the student loan debt will be deferred at least 12 months beyond the date of closing, a monthly payment does not need to be considered.

b. If a student loan is in repayment or scheduled to begin within 12 months from the date of VA loan closing, the lender must consider the anticipated monthly obligation in the loan analysis and utilize the payment established in paragraph (1) or (2) below. Calculate each loan at a rate of 5 percent of the outstanding balance divided by 12 months (example: $25,000 student loan balance x 5% = $1,250 divided by 12 months = $104.17 per month is the monthly payment for debt ratio purposes).

(1) The lender must use the payment(s) reported on the credit report for each student loan(s) if the reported payment is greater than the threshold payment calculation above.

(2) If the payment reported on the credit report is less than the threshold payment calculation above, the loan file must contain a statement from the student loan servicer that reflects the actual loan terms and payment information for each student loan(s).

USDA Guidelines

https://www.rd.usda.gov/files/3555-1chapter11.pdf

For outstanding student loans, regardless of the payment status, lenders must use:

The payment amount reported on the credit report or the actual documented payment, when the payment amount is above zero; or

One half (.50) percent of the outstanding loan balance documented on the credit report or creditor verification, when the payment amount is zero.

2 Options for MLO's to Use for Clients Who Need Help With Student Loan Repayment Plans and Solutions for Defaults!

1. SDS is a DIY Solution for Clients

Who Need Student Loan Help

If your client has federal student loans and is not already set up with a repayment plan, there is a federal government resource at Studentaid.gov.

Or, your client can go to Student Debt Solutions (SDS) and get a list of all plans available to them for FREE by answering a short list of questions.

This is a good resource for a client:

- that only needs help with a student loan repayment plan or student loan default solution to get a mortgage.

- whether they need a purchase or refinance mortgage.

2. SDS is also used by HomePrep, Where MLOs and their Clients Connect to a HUD Counselor!

Looking to refer your clients with issues preventing them from proceeding with a mortgage to a professional trained to get the client mortgage ready? Consider using HomePrep that connects the MLO and client to a HUD counselor that can provide and follow up with your client for Student Loan help using Student Debt Solutions (SDS) and a number of other services provided through HomePrep!

When the client is ready for a mortgage, you are notified!

Student Debt Solutions

Payment is only needed for applying for your Plan.

Standard: $60

- Required Forms

- Instructions

- Automation Tools

- Expert Chat Service

Premium: $160

- All of the Above

- Live Counseling Session

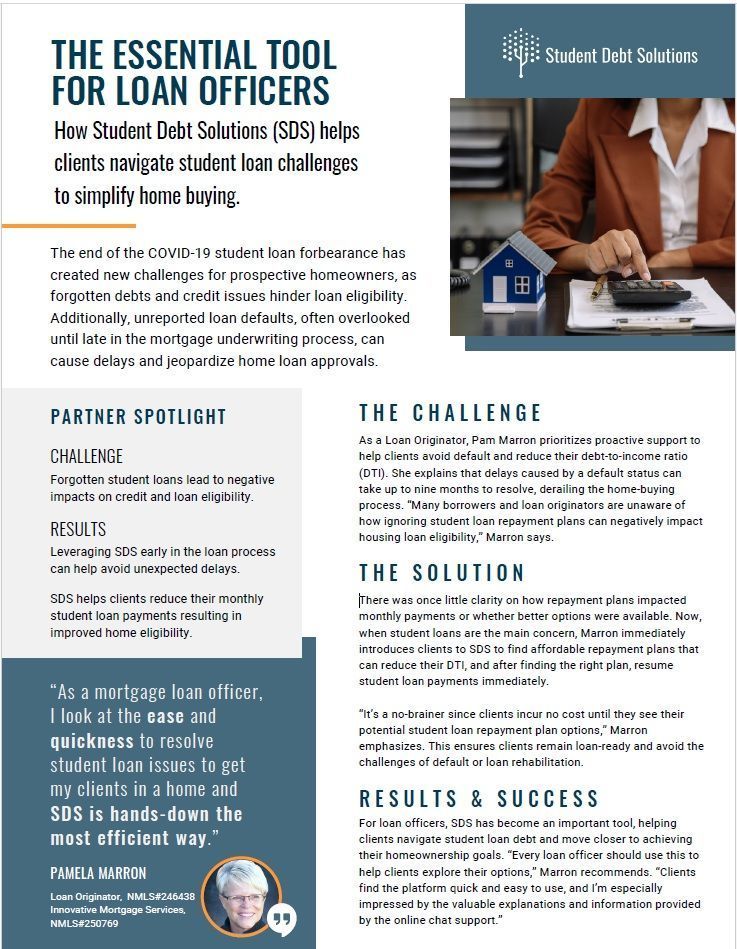

Click on flyer for SDS:The Essential Tool for Loan Officers

Loan Originator Recommends... Present Challenge, Solution and Results!

For loan originators who have clients with student loans, whether federal or private, this program gives options that may decrease a student loan payment and increase buying power to purchase a home, or even escalate a payment to pay student loan debt off early.

- provides details of all federal programs that the client is eligible for and is FREE to view. Client only pays if they want SDS to assist them to sign up for a plan.

- compares the savings of a current student loan payment to a new repayment plan.

- Has outstanding support!

- can provide a refinance of private student loans.

- offers defaulted student loan solutions.

Disclaimer: Pamela Marron, Licensed Loan Originator, NMLS#246438 , receives no compensation from any services shown on Clients2Homeowners.com.