Equal Housing Lender

Introducing the HomePrep Pilot

How It Benefits Independent Mortgage Loan Originators!

Event Title and Details:

Title: Introducing the HomePrep Pilot and How It Benefits Independent Mortgage Loan Originators!

Date: October 18th, 2023

Time: 11:00 AM to 12:00 PM

Location: Online Webinar

What is HomePrep?

HomePrep is an IT platform designed for the mortgage industry. It connects independent mortgage loan originators (MLOs) with HUD certified counselors. These MLOs have clients facing issues that hinder them from moving forward with a mortgage, and the certified counselors are trained to assist these clients in becoming ready for a mortgage.

HomePrep Services Were Formed With Independent MLO’s in Mind!

Have you had any of these issues? How many times have you as an MLO…

- Pre-qualified a client who has issues that prevent them from going forward with a mortgage?

- Started helping clients because lower production allowed the time, but then you get too busy to give these same clients the attention needed to resolve their issues?

- Not been able to give an option at all for these clients to who need help?

- Had a client who signed a contract, started a loan application, and then you pull an AUS only to find problems that can threaten a credit score or the loan?

I know I have.

The services that you see under “What Does HomePrep Provide?” cover the most common issues that potential mortgage seekers have today. Lack of funds to purchase a home, lack of a good enough credit score…. or even enough credit, along with a serious student loan repayment plan are at the top of the list of need for clients.

Budgeting and Homebuyer Education is always needed and the icing on the cake is a Freddie Mac AUS done with a soft pull credit report upfront! No trigger leads from a hard pull credit, and AUS findings that give you a roadmap for you for your client.

MLO Benefits

While the MOU is an enticement for the client to return to the loan originator, there are other MLO benefits, such as:

- MLOs can offer clients the opportunity to receive guidance from trained HUD counselors, who will assist them until they're ready for a mortgage.

- They ensure regular updates to the realtor about the progress of any referred clients.

- A certified HUD counselor handles preparing the client for a mortgage, allowing the MLO to focus on originating more loans.

- This process ensures a steady flow of future clients who are prepared for a mortgage.

What Does HomePrep Provide?

HomePrep is designed to provide three of the most needed services that prevent clients from going forward with a mortgage:

- Credit Help, for both short-term (up to 6 months) and long-term (7 months to 5 years) needs.

- Down Payment Assistance (DPA), either using DownPaymentResource.com and their back end national tool called Down Payment Connect for MLO’s and realtors OR work with HUD certified counselor to match the client with down payment assistance located in all 50 states.

- Student Loan Repayment Plans that assess various options, including income-driven plans, potential loan forgiveness, and assistance with overdue student loans.

Three additional services are also provided:

- Budgeting, required for all clients

- Homebuyer Education needed for down payment assistance and Fannie Mae and Freddie Mac Affordable products

- Client application is put through the Freddie Mac HomeCoach automated underwriting system (AUS) with a soft pull credit.

How It’s Funded

18 months ago, the software team at Indisoft, a leading IT company with a rich history of linking HUD counselors to mortgage services, collaborated with independent mortgage loan originators. Their goal was to aid clients in becoming better prepared for mortgages.

While big banks had established a way for retail mortgage loan originators to connect with HUD-certified counselors—using Community Reinvestment Act (CRA) funds for pre-purchase HUD counseling—there was no such fund for independent MLOs. The solution was to establish a "Fee for Services" system where clients pay upfront. However, there's a catch: an agreement, termed a Memorandum of Understanding (MOU), would ensure that if the client returns to the original MLO for their mortgage, the MLO would provide a set credit towards the client's closing costs.

Clients To Consider Referring

For Mortgage Loan Originators, knowing which borrowers can benefit most from HomePrep can make the mortgage process smoother and more efficient. Here are the types of borrowers you should consider referring to HomePrep:

- Credit-Challenged Borrowers: Individuals who might be facing credit issues, whether they're minor setbacks or larger challenges, will greatly benefit from the credit assistance services provided by HomePrep.

- First-time Homebuyers: Those new to the home buying process can often be overwhelmed. HomePrep offers Homebuyer Education to guide them through the intricacies of purchasing a home.

- Borrowers with Student Loans: If you have clients burdened by student loans, especially those unsure of their repayment options or those with delinquent loans, HomePrep's Student Loan Repayment Plans can be invaluable.

- Borrowers with Limited Down Payment Resources: Clients who are unaware of or confused by down payment assistance options can utilize HomePrep's services to discover opportunities tailored for them.

- Budget-Conscious Borrowers: Those who might benefit from budgeting guidance to better manage their finances and afford a home will find value in HomePrep's budgeting service.

- Borrowers Seeking Transparent Loan Approvals: With the Freddie Mac HomeCoach AUS using a soft pull credit, borrowers who desire clarity without harming their credit score can be ideal candidates.

- Borrowers Who Have Previously Faced Application Rejections: Individuals who've faced challenges or rejections in previous mortgage applications can benefit from a fresh, guided approach via HomePrep.

- Realtors and Agents Seeking a Reliable System: Professionals in the field who regularly encounter potential borrowers with varied needs will find HomePrep an excellent resource to direct their clients towards.

By identifying and referring these types of borrowers to HomePrep, MLOs can ensure their clients receive tailored, expert advice, increasing the chances of successful loan origination and fostering long-lasting client relationships.

Take Advantage of This Trial Time With HomePrep

There's no better time than now to explore the full potential of HomePrep. As we roll out our platform designed with both MLOs and borrowers in mind, we're offering an exclusive trial period. This is a golden opportunity to familiarize yourself with the range of services we provide, witness the benefits firsthand, and understand how HomePrep can revolutionize the way you approach mortgages.

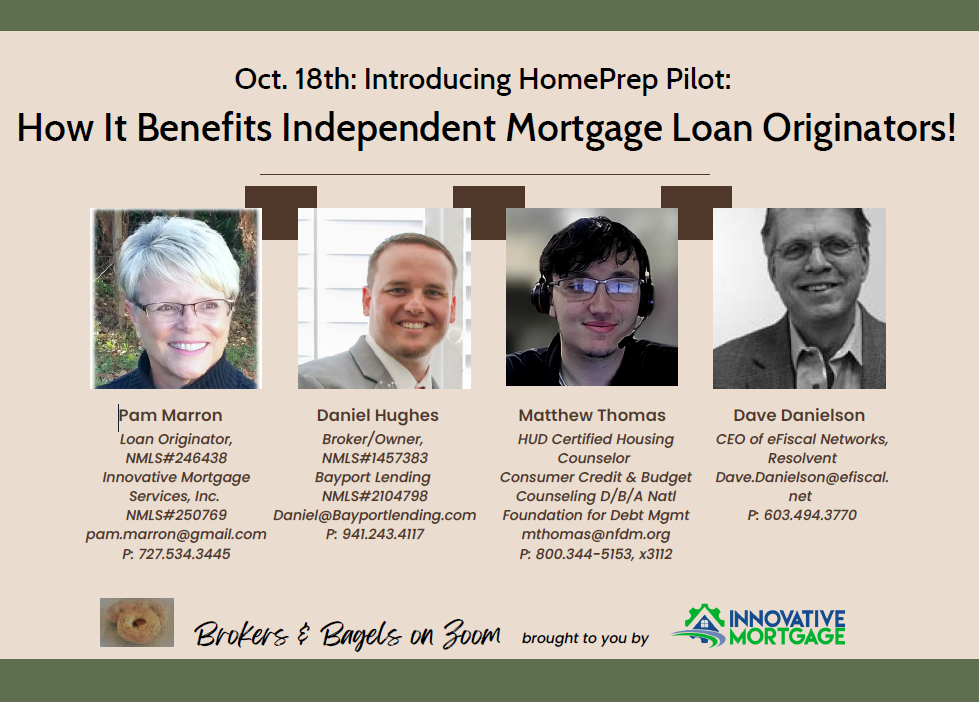

Join Us for Brokers and Bagels!

Dive deeper into the HomePrep experience by joining us for our upcoming "Brokers and Bagels" event. This will be a great chance to network, ask questions, and get a comprehensive understanding of all that HomePrep has to offer.

Details:

Date: October 18th

Time: 11 am

Where: Zoom webinar

Registration: https://us06web.zoom.us/meeting/register/tZcuf-irpjgrGNL7YZyJSe7D-57hiE11Eeb2

Don't miss out on this opportunity. Mark your calendars, set your reminders, and let's meet up to discuss the future of mortgage readiness. See you there!

Andrew Kashella

Sr. VP/Chief Tech Officer, NMLS 139171

Innovative Mortg Svcs Inc., NMLS 250769

Mobile: 727-222-4575

Email: Andrew@InnovativeMLO.com

Website: InnovativeMLO.com

Pam Marron

Licensed Loan Originator, NMLS 246438

Innovative Mortg Svcs Inc., NMLS 250769

Mobile: 727-534-3445

Email: pam.m.marron@gmail.com

Website: CloseWithPamandTara.com