Equal Housing Lender

The idea of independent loan originators partnering with housing counselors to assist challenged clients was surrounded by skepticism from day one. Initial conversations with housing counselors about past experiences of working with independent loan originators often included negative stories where help favored the loan originator more than the client. I also found that many in my own mortgage industry were not aware of help that housing counselors could provide to our challenged clients.

Forming the relationship between independent loan originators and housing counselors was a bigger obstacle than getting the pilot program off the ground. The key was to show the economic value of working together … not only to the loan originator and housing counselor, but to the client and the real estate agent.

When chronic issues exist, one of two things occur. Either we figure out a way to deal with it, or we hire a service that knows how to fix it. Loan originators who deal with challenged clients have varying degrees of success and when originating business increases, time to deal with client issues dissipates.

Because I served on the HUD Housing Counseling Federal Advisory Committee (HCFAC), I learned firsthand how housing counselors can assist challenged clients. I specifically focused on how housing counselors can assist clients in three main areas:

►Help with credit issues;

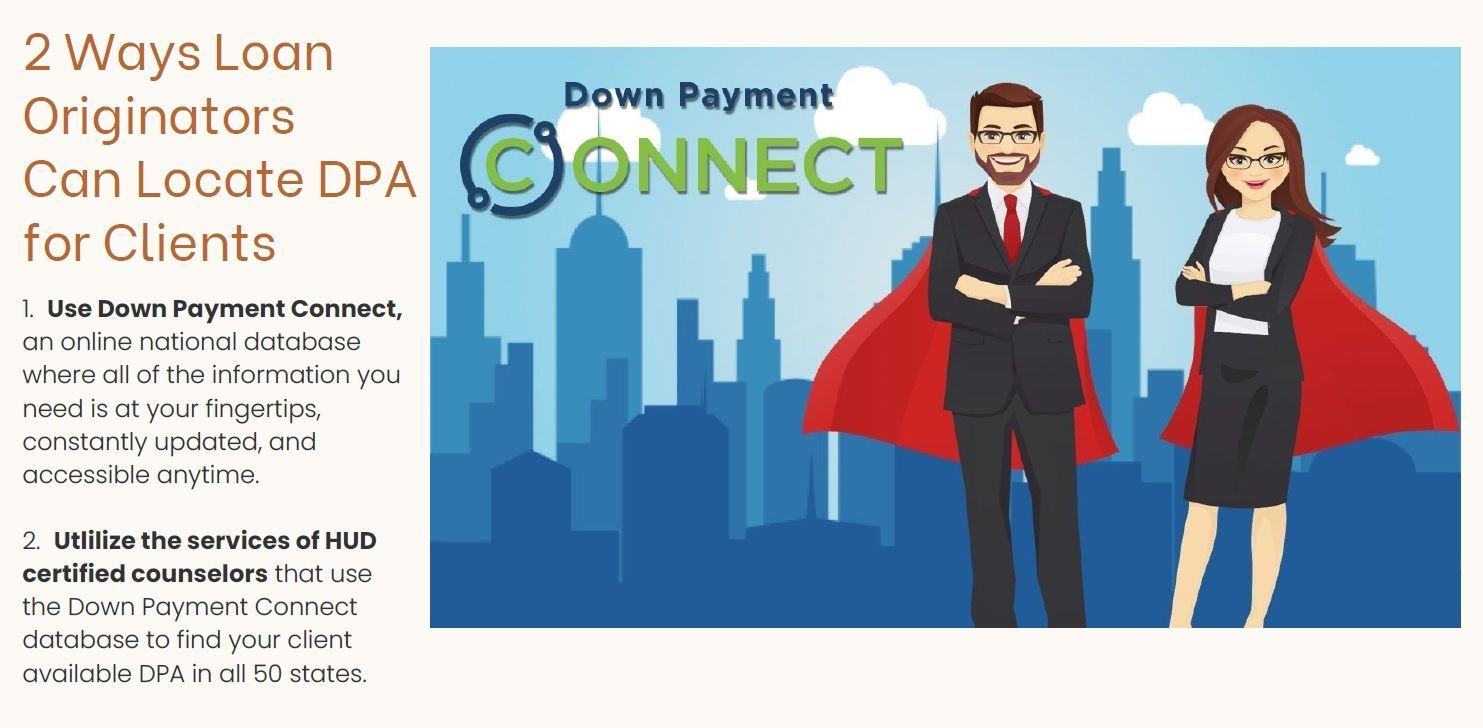

►Assessing for available downpayment assistance; and

►Budgeting to buy a home.

► Student Loan Debt Relief added

To make this partnership program work, there needed to be the “service that knows how to fix it” for specific and consistently encountered mortgage client needs.

Another area of detail was how client help could be paid for. Housing counseling agencies (HCA) historically work with banks and credit unions who can provide Community Reinvestment Act (CRA) funds upfront to pay for services. Independent loan originators do not have CRA funds, so a pre-set Fee-for-Service Plan was put in place where clients pay for needed services upfront, but then receive a credit back towards closing costs at their mortgage closing.

A Memorandum of Understanding (MOU) was developed that specified the credit to the client from the referring loan originator. Great care was taken to ensure that anti-steering laws were abided by. Another positive point that resulted was the fact that the Fee-For-Service model provided a valid source for above low- to moderate-income (LMI) clients to utilize housing counseling services.

Connections developed and buy-in

Fast-forward to August of 2018 …

The pilot was started in Tampa Bay, Fla. that connects loan originators to housing counselors to assist challenged clients.

What are the benefits to independent loan originators when working with HUD-approved housing counseling agencies? 1. Provides option to assist real estate agents with all challenged clients. Provides continued communication between the housing counselor and loan originator, and the loan originator to client and real estate agent on progress towards the clients’ eventual home purchase. 2. Provides trained professionals who can assist challenged clients through issues to get them mortgage ready. 3. Provides valid fee-for-service method of payment and an option for assistance for all income levels.

What are the benefits to HUD-approved housing counselors when working with independent loan originators?

1. An increased client base serving independent loan originators ( 511,000-plus licensed mortgage loan originators in the U.S. ) with specific method for partnership developed to fit within existing housing counseling guidelines. 2. Expansion of services to above low- to moderate-income (LMI) clients through the Fee-for-Service model.

Continued skepticism drives effort forward while successes grow

We continue to face skepticism. Recording clients who have made it to homeownership and time to prove the pilot can work is needed to overcome past negative perceptions and gain awareness of how independent loan originators partnered with housing counselors can work.

Who is interested in this pilot has been interesting … an entrepreneur who sees the value in assisting employees into homeownership, a real estate agent who wants to work directly with the housing counseling agency, a mortgage company CEO who wants housing counseling to be an integral part of his company. My own surprise came when a client was ready to purchase a home sooner than expected and was helped to that point by someone other than me. This continues, this will grow … spread the word.

Stay tuned.

Pam Marron (NMLS#: 246438) is senior loan originator with Innovative Mortgage Services Inc. (NMLS#: 250769) in Tampa Bay, Fla. She may be reached by phone at (727) 375-8986, e-mail PMarron@InnovativeMortgage.onmicrosoft.com or visit CloseWithPam.com .

Streamlining the Path to Homeownership: The Benefits of Using HomePrep to get Clients Mortgage-Ready