Equal Housing Lender

Follow these 3 steps to avoid any chance of negative student loan credit showing up after a client has signed a contract for a home.

When reviewing the credit report for a mortgage of clients who have student loans, it is common not to see the current student loan credit, or student loans are shown but they are from the previous servicer. Student loan forbearance was in place for so long that when clients are asked what their payment is (often not shown or a $0 on the credit report), most clients need to dig for this before providing the answer. Once you have retrieved this written information from your client, don’t proceed with a pre-approval before doing these three things.

1. Make sure your client retrieves a payment history letter from their current servicer and make sure it is for a full 24 months. Directions for how to retrieve this information for federal student loans can be found at Studentaid.govat “How can I see my federal student loan payment history?” This page provides most servicers, and direction to locate which servicer you have if you don’t this.

For borrowers whose student loans were transferred, your online payment history shows only the payments you’ve made to the current servicer. Reach out to your current servicer directly if you need your complete payment history, including payments made to your previous servicer. Getting the complete payment history is especially important if you have had missed or delinquent payments in your student loan payment history. Student loan default starts at 270 days, which equates to 9 months.

2. Make sure that the letter from your servicer has a minimum monthly payment provided. Having a $0 monthly payment will require that the loan originator count a minimum percentage amount of the full loan balance towards the client’s student loan debt. Most often, the required payment can be calculated by the servicer and is often lower than the percentage dollar amount required by each mortgage loan type.

Additionally, if the student loan still shows in “forbearance”, an automatic 1% of the balance is the required payment that loan originators need to insert for student loan debt.

3. Run your client’s loan application through both the Fannie Mae Desktop and Freddie Mac Loan Product Advisor automated underwriting systems (AUS) before issuing a pre-approval letter.

The Fannie Mae and Freddie Mac AUS systems can see back-end credit that may not be visible on a mortgage credit report. This credit can be checked through Meridian Link if your credit reporting agency (CRA) uses this system, but not all CRA’s do.

On both Fannie Mae and Freddie Mac automated systems, go to Findings and check Credit for any directions related to student loan accounts and follow them.

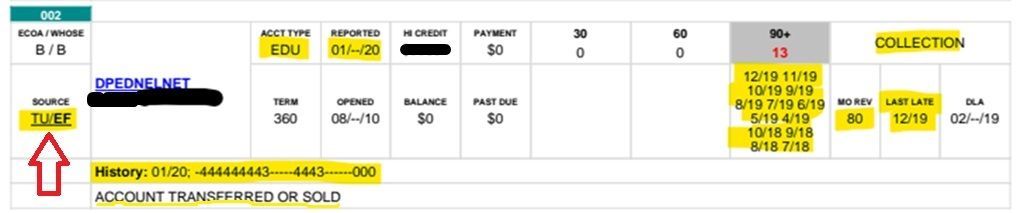

Where Meridian Link is accessible if your credit reporting agency has it. Note that 13 months of late payments show up under

90+ days late. This could be a defaulted student loan already.

Meridian Link connects to the individual credit bureaus of Trans Union, Equifax and Experian to show the individual credit bureau history for each creditor.

The start-up of recording student loan credit again has been in affect since 10/1/2024. Make sure that you and your client don’t experience getting a denial after they sign a contract by applying this direction before you give a pre-approval for a client that has student loans on their credit report. This can also avoid expensive Rapid Rescore costs mid-process that a loan originator has to pay for in order to correct hidden credit issues that can appear on the Fannie Mae and Freddie Mac AUS findings but aren't visible on the mortgage credit report.

Go to DIY Student Loan Help for Clients at Clients2Homeowners.com for more.

Article author Pamela Marron is a licensed loan originator (NMLS#246438) who made Clients2Homeowners.com as a resource for mortgage loan originators to assist clients with challenges preventing them from obtaining a mortgage. Ms. Marron receives no compensation from any services mentioned on the website.