Equal Housing Lender

For Loan Originators and Realtors:

My last article stated that mortgage loan originators needed to get over their worries about using down payment assistance 2nd mortgages to stay competitive. But understanding the right connection between a first mortgage and a down payment assistance 2nd mortgage is often easier said than done. As my business partner Tara and I investigate and use more DPA programs, we are detailing what to look for about DPA programs on a matrix. In the near future, we will make this document available.

Now is the best time to learn about adding down payment assistance (DPA) for qualified borrowers who have good ratios and decent credit but lack funds to purchase a home. There are more DPA programs available now for FHA, conventional, USDA and VA loan products than ever before. The best reason to know about these programs is that DPA funds can cover down payment and usually a good amount of the closing costs that sellers aren’t willing to pay in todays heated housing market. This makes buyers with DPA more competitive than buyers who need closing costs covered.

But DPA programs don’t come without challenges. Often, a DPA issue can arise during the processing of a loan and if the 2nd mortgage for DPA funds cannot be approved, the only remedy to complete the deal may be a gift at the last minute.

Areas explored and some of what we discovered is laid out below.

- In comparing FHA 96.5%LTV and conventional 97%LTV loan programs with DPA added, we found that when a borrower’s credit score is over 700, the combined conventional mortgage payment is usually lower than the combined FHA payment due to lower private mortgage insurance (PMI). The closing costs compared were just slightly higher for the conventional loan.

- Borrowers who need DPA to help with home purchase costs need to have funds in the bank. For borrowers who have lower credit scores and are tight or slightly over on the front FHA ratio, one to two months of reserves is needed to get the loan approved through automated underwriting required for many programs. This is because the higher combined loan to value (CLTV) of the first and 2nd DPA mortgage poses a greater risk. Run your clients through the Fannie Mae Desktop Originator or Freddie Mac Loan Product Advisor programs upfront.

- Be careful to check the exact program income criteria for area median income (AMI) that clients need to qualify for with each DPA. Some programs require that only the income of the borrower applying for the loan should be analyzed, while other programs require household income for all members of the family to be used.

- Know the geographic area a DPA program can provide funds for on a home purchase. Community Reinvestment Act (CRA) DPA funds are available for home purchases within a mapped area.

- Check to see if there are program differences for different property types, such as a manufactured home versus a single-family residence (SFR). I recently found that a manual underwrite was available for SFR’s but not on a manufactured home.

- On any DPA program, always ask UPFRONT if there are any overlays or unique underwriting criteria for the specific program.

- Know upfront if the 2nd mortgage payment will need to be included in ratios and what those maximum ratios are.

- There are two different areas to insert the DPA program on the NEW URLA: 4b. and 4d. Make sure that you know if the DPA payment needs to be included in the ratio (4b.) or is considered a soft 2nd that can be forgivable with specific criteria met, and may be considered a gift or grant (4d.) Check with the DPA lender for specific guidelines of where to insert the DPA into the NEW URLA in either 4b. or 4d.

- Some DPA programs are originated at the first mortgage lender and the first mortgage and 2nd DPA program are underwritten together. Other DPA programs require separate submissions, such as county SHIP loans, that piggyback with a first mortgage such as the Fannie Mae HomeReady and Freddie Mac Home Possible 97% first mortgages and FHA first mortgages.

- The TWO BEST TOOLS to have in your toolbox when using DPA:

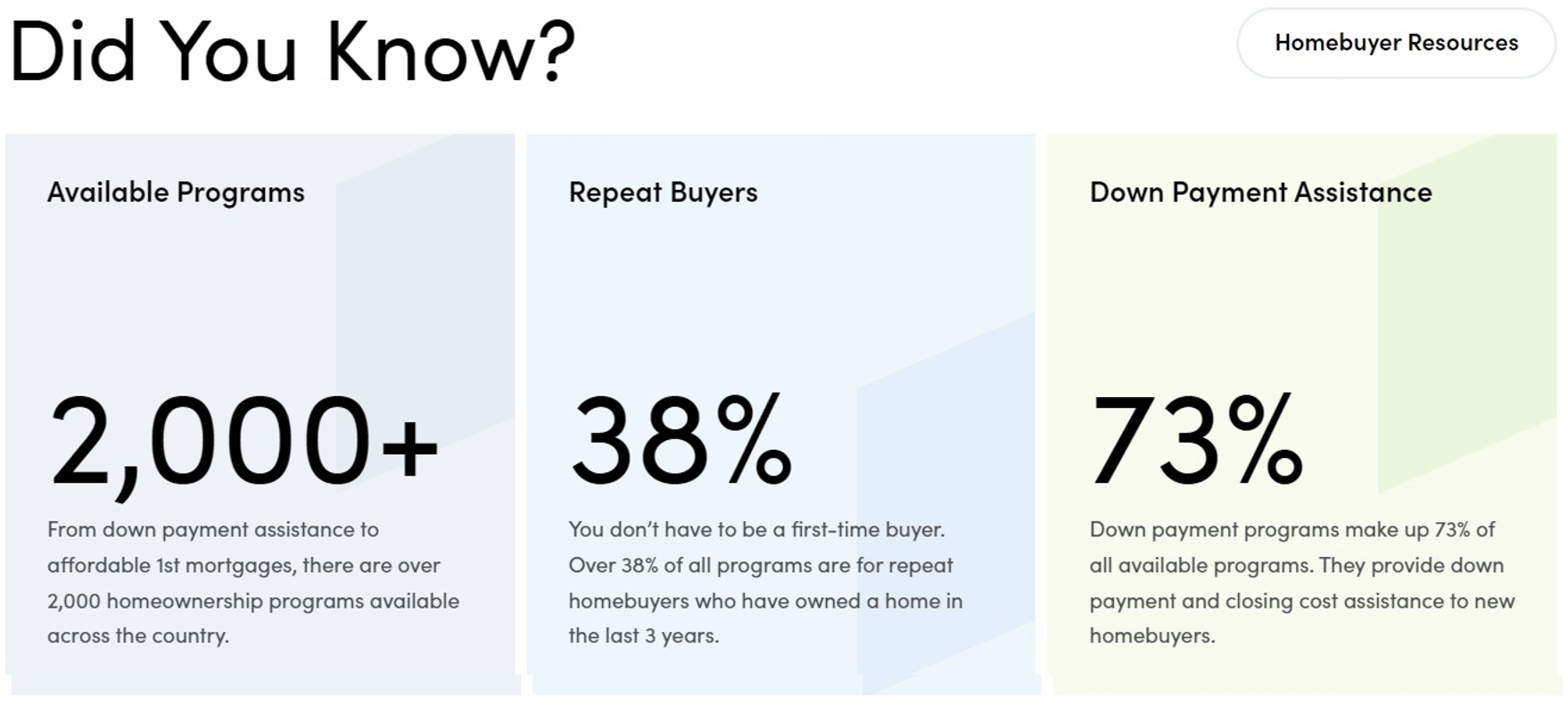

- For a fee, sign up at Down Payment Connect within DownPaymentResources.com to promote that you provide DPA! Within Down Payment Connect, you get an incredibly detailed program overview of over 2000 county, city and state DPA programs and many proprietary programs across the U.S.

- Find a HUD counselor at HUD.gov who can provide Pre-Purchase Counseling and Pre-purchase Homebuyer Education Workshops and send borrowers to them!

As you can see there are a lot of details to put in order. If you are a DPA provider, loan originator, realtor or HUD housing counselor who would like to help us expand this DPA matrix that provides details that can help our industry better utilize DPA programs, please contact us at clients2homeowners.com or call Pam Marron at 727-534-3445.