The mortgage industry is poised for a potential uptick in production due to a long-awaited reduction in interest rates. This presents a valuable opportunity for mortgage professionals to help clients, especially those burdened with student loans, to secure favorable mortgage terms. To fully capitalize on this, it’s crucial for loan originators to focus on three key areas: the impact of credit report changes after September 30, 2024, the benefits still available for federal student loans, and knowing the differences between federal and private loans. An example of a self-service student loan analysis tool that can be used for FREE can be found in this article.

MLO's, Collaborate

with Your Clients and a HUD Counselor using HomePrep!

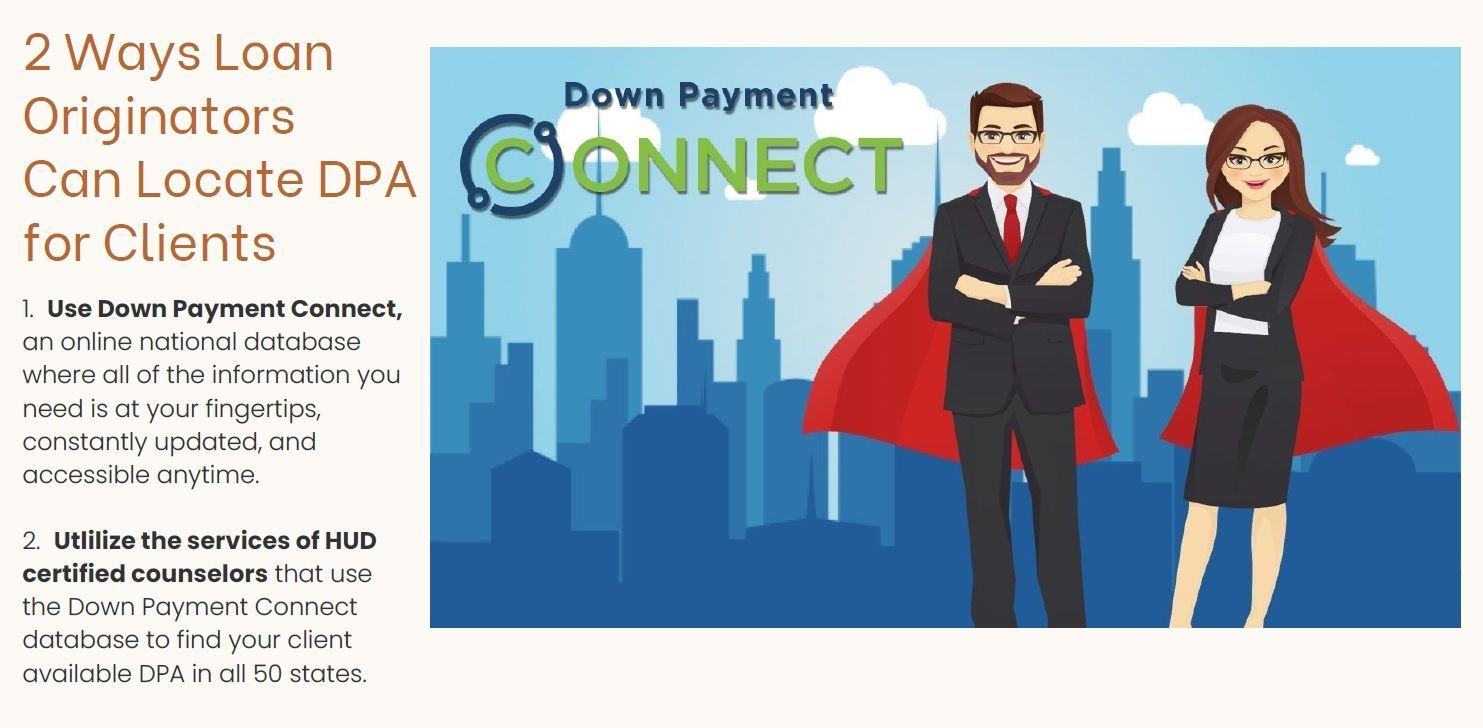

Most MLOs would rather refer clients to professionals that can help their client overcome obstacles preventing them from getting a mortgage. The problem is, MLO's don’t know where to direct these clients.

The solution? HUD-approved housing and certified credit counselors. These professionals work closely with clients, guiding them through renting, buying, and staying in their homes.

Enter HomePrep. This innovative online platform seamlessly connects MLOs and their clients to trusted HUD counselors who specialize in resolving mortgage roadblocks. The best part? Once a client is mortgage-ready, the MLO is notified, ensuring they don’t miss out on a future loan opportunity.

The Dilemma

Why Most Loan Originators Don’t Help Clients Who Need Assistance

Mortgage loan originators (MLOs) are in the business of closing loans—not fixing credit, resolving financial challenges, or guiding clients through complex homeownership hurdles. While many MLOs want to help, they often don’t because:

🔹 Lack of Time – MLOs work on commission, meaning their income depends on closing loans. Spending hours helping clients who aren’t mortgage-ready takes time away from qualified borrowers.

🔹 Limited Resources – Most MLOs don’t have a go-to solution for clients with poor credit, high debt, or homeownership inexperience. Without a clear next step, they simply move on.

🔹 No Follow-Up System – Even if an MLO refers a client to outside help, there’s no guarantee they’ll ever hear back when that client becomes mortgage-ready—leading to missed opportunities.

This is where HomePrep changes the game. It seamlessly connects MLOs and their clients to trusted HUD-approved counselors and credit experts who help clients overcome obstacles. Best of all, MLOs receive automatic updates when a client is ready to buy, ensuring they don’t lose potential business.

With HomePrep, MLOs can help more clients—without sacrificing your pipeline.

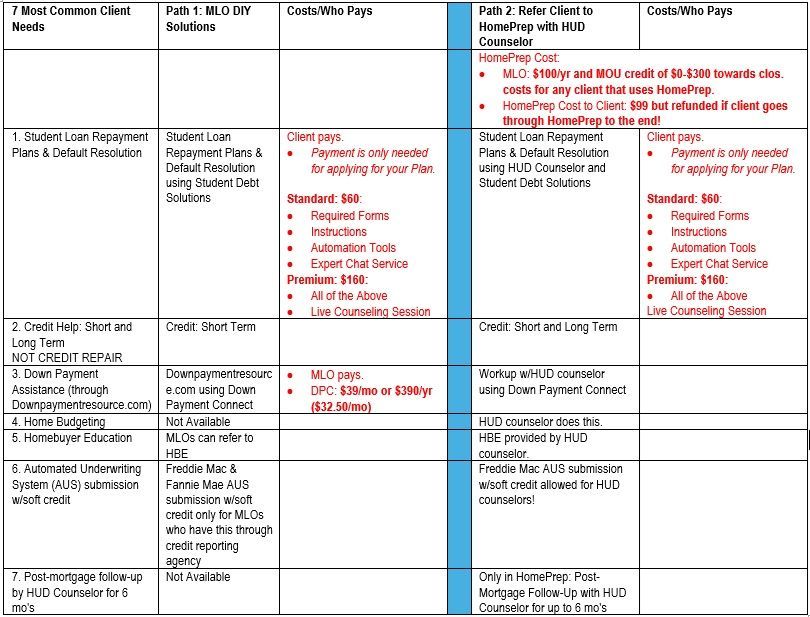

2 Paths of Services for MLOs and Their Clients

Path 1: MLO DIY (Do It Yourself) Solutions and Path 2: Refer Client to HomePrep with HUD Counselor

Service Costs and Who Will Pay.

The Best Resources For MLOs Assembled

MLO DIY Solutions

"How To" resources for MLOs that want to learn how to use tools that can expand education of challenges and how your client can overcome them.

Some services are FREE but some are at a cost to the MLO or your client.

Costs are noted on services Home, MLO DIY Solutions and HomePrep for MLOs pages.

HomePrep for MLOs

MLOs refer challenged clients to HUD counselors to correct issues. When the client is "mortgage ready", the MLO is notified!

There is a cost to use HomePrep for the MLO. Some services also have a cost for your client or the MLO.

For more about HomePrep for MLO's, click here.

Other Resources

Articles, mortgage trade groups, mortgage advocacy, tips from industry professionals and more!

For more Resources, go here!

Disclaimer : Pamela Marron, licensed loan originator NMLS# 246438 and developer of Clients2homeowners.com, receives no compensation for any services shown on this website. This website was made for mortgage loan originators to assist clients who have challenges getting a mortgage.