Equal Housing Lender

DIY Down Payment Assistance for MLO's

Downpaymentresource.com provides a FREE DPA Lookup for homebuyers, MLO's and Realtors.

But the jewel of Downpaymentresource.com is Down Payment Connect, a subscription based DPA Directory and

promotional tool that provides a searchable database of comprehensive information for each DPA in the subscribers' state.

Plus, a landing page for every MLO to promote DPA from!

DownPaymentResource.com

A FREE public-facing and MLO resource that pares down all available programs for prospective homebuyers.

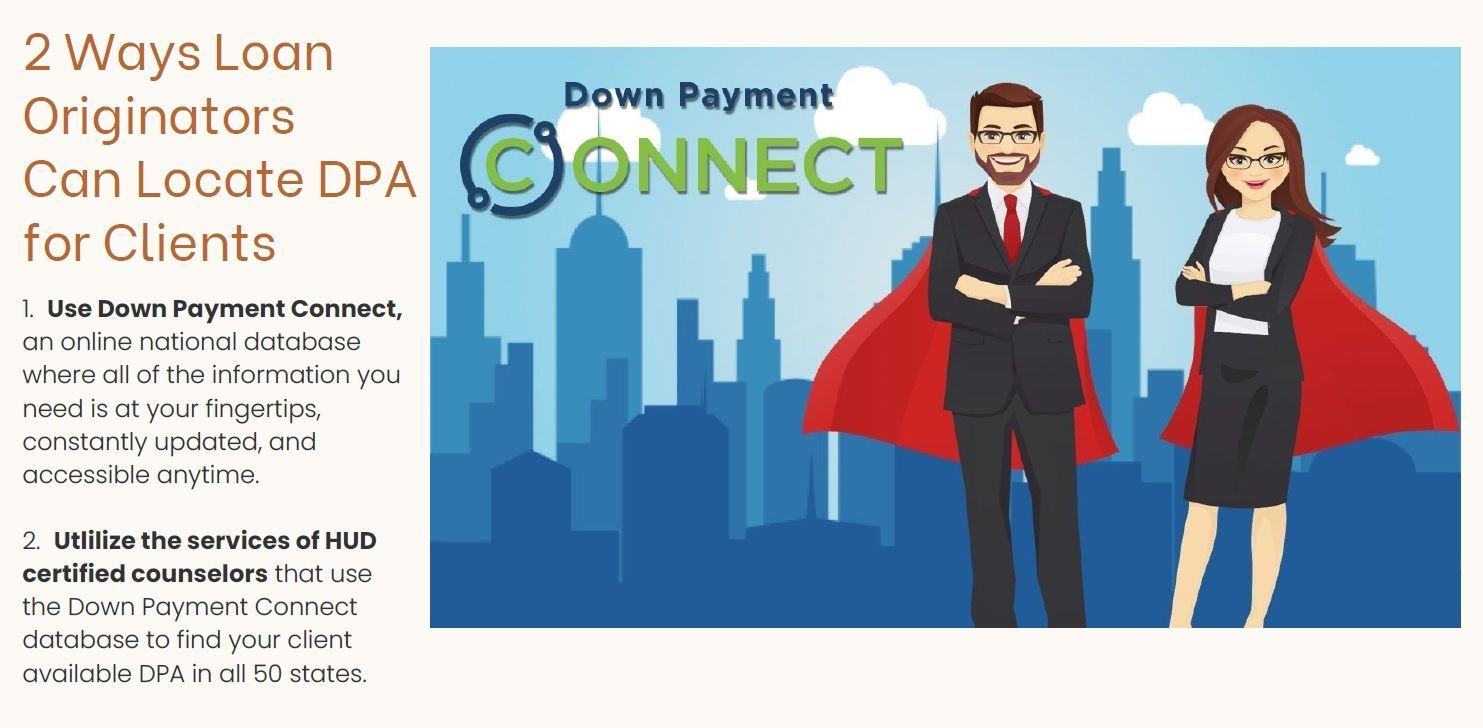

Down Payment Connect

A searchable subscription database that provides comprehensive detail for city, county, SHIP & state DPA as well as proprietary and wholesale programs. Also, an MLO landing page to promote DPA.

DPA FAQs

If you are new to down payment assistance programs, check out some of our MLO FAQs.

Down Payment Resource®

DownPaymentResource.com

Get your clients the DPA help they need !

DownPaymentResource.com is a website that houses detail about all U.S. DPA programs including popular county SHIP programs, city and state programs and now even DPA available to licensed loan originators through mortgage wholesalers.

Homebuyers

Access Down Payment Resource directly to get a snapshot of what DPA programs are available to you.

MLOs and Realtors

Details about available DPA programs and charting differences between 1st mortgages and added DPA products has been a struggle in the past for loan originators. Through

Down Payment Connect, a subscription based service, you can have access to a statewide DPA directory and are provided a DPA landing page that connects clients directly to you. The robust DPA Directory has recently added filters that can help sift out DPA for clients based on income levels, property type, location, if a grant or 2nd mortgage and more!

DPA Frequent Questions from MLOs

DPA Articles to Help MLOs

Streamlining the Path to Homeownership: The Benefits of Using HomePrep to get Clients Mortgage-Ready