Equal Housing Lender

1.Prepare Your Clients to Use Student Debt Solutions!

Prepare clients with what they need to have available to use SDS.

Information Clients Need to Have Available to Use SDS

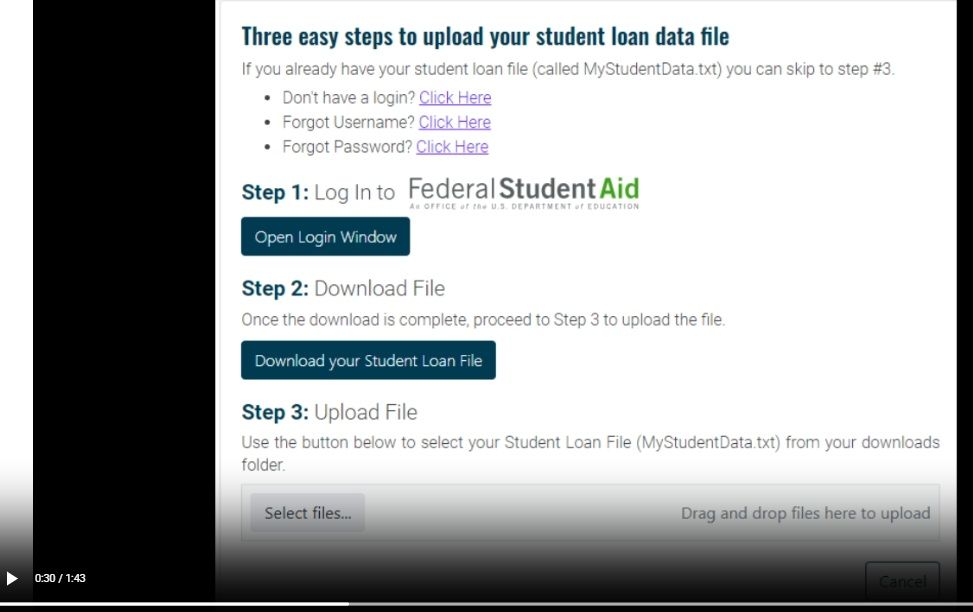

- For federal loans, NSLDS file username and password.

- Have your FSA ID ready.

- For private loans, most recent statement.

- Family size, income and tax filing status.

- What is your goal? Lower monthly payments or lower overall repayment amount?

- Are payments current, late or in default?

Have your FSA ID ready

- If you don't remember your FSA ID, go to https://studentaid.gov/fsa-id/sign-in/retrieve-username.

- Directions to enter a secure code from authenticator app, text a secure code to mobile phone, email a secure code, answer challenge questions or recover account with a photo ID will be provided.

2.Student Debt Solutions Demonstration

Explore SDS from beginning to end with Student Debt Solutions Platform Demonstration with Melissa Maguire, SDS Student Loan Consultant and Expert

See information that client inputs that results in client seeing all eligible plans for FREE! The client is only charged if they would like to proceed with a plan.

The demonstration shows how a plan can be selected, paperwork is completed on SDS website, downloaded, signed and sent!

3.Have Client Create an Account at Student Debt Solutions

Loan Originators can have clients go to Student Debt Solutions here, create an account, answer questions and see all eligible student loan repayment plans within 20 minutes and for FREE. Clients are only charged if they use SDS to implement plan.

4.Student Debt Solutions Cost

If your client wants to implement a Repayment Plan, here are costs:

Standard: $60

•Required Forms

•Instructions

•Automation Tools

•Expert Chat Service

Premium: $160

•All the Above

•Plus Live Counseling Session

5.MLOs: More Notes...

- Have client take screenshot of SDS page that shows current payment next to possible repayment plan and give to MLO!

- MLOs, read MLOs: Review 7 Points Before Pre-Approving Clients with Student Loans and check all 7 steps before proceeding with a pre-approval for clients that have student loans.

- If you'd rather have a HUD counselor put client through SDS and follow-up, email Andrew Mason, NFDM.org HUD HomePrep Counselor.

- If your client doesn’t know what their current payment is, have them use SDS to find out and check on other plans available to them to compare.

- Payment Plan implementation takes 30-60 days to complete. Don’t let clients write a contract before getting plan in place!

- Help kKeep Student Loan Clients Out of Default! Default can result in higher payment, may be longer forgiveness wait (if available) and client wait timeframe of 6-9 mo’s to get new mortgage while student loan credit improves with on-time payment arrangement.

- Make sure clients set up new repayment plan and recertify income ASAP! Client should make sure they’ve arranged for additional forbearance while this is being processed!

- IMPORTANT: current student loans and payment history ARE NOT showing up on many credit reports yet! Run client’s loan through FNMA/FHLMC AUS and review Findings direction before giving pre-approval!

If you are an MLO that needs help with a client that has student loans, please contact Pam Marron at 727-534-3445 or email pam.m.marron@gmail.com. We are looking into various credit problems that have come up with student loans and want to see these clients through while resolving their issue. Because this is a recent concern, there is a need to see what AUS credit shows and what AUS findings occur. By allowing help, you are assisting mortgage professionals who want to get in front of any problems for clients with student loans to make their process smoother for all of us!