Equal Housing Lender

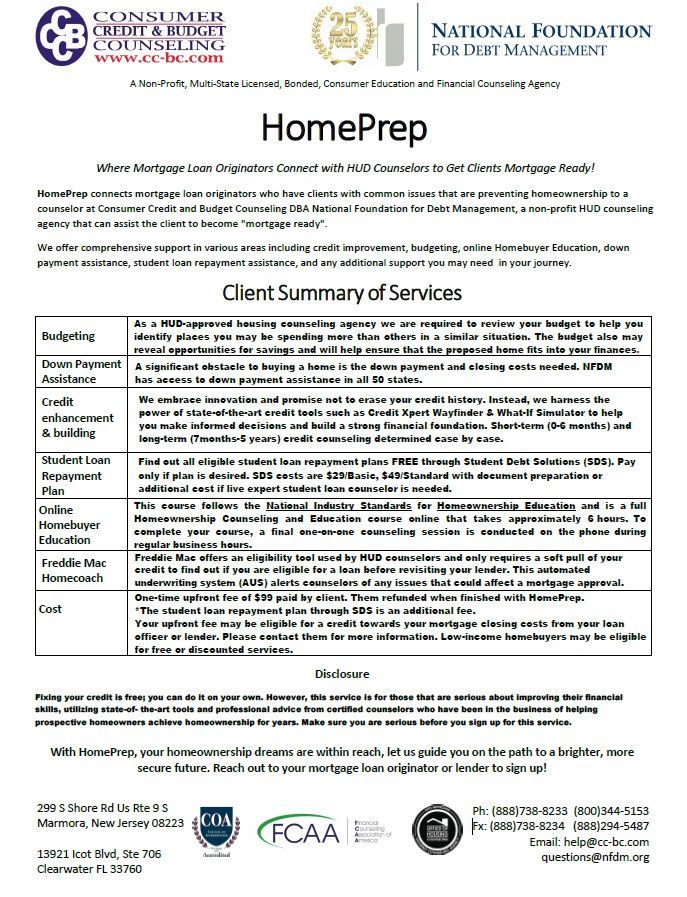

HomePrep for Clients

Where MLO's Connect with HUD Counselors to get Clients Mortgage Ready!

MLO's

Directions for Clients referred to HomePrep for services to get mortgage-ready!

What's HomePrep?

HomePrep is a technology platform that connects Mortgage Loan Originators with clients on their path to homeownership to HUD Counselors that help them achieve it!

The connection between MLO's, their clients and HUD counselors is made possible by Indisoft, a national mortgage software company.

National Foundation for Debt Management, a national non-profit HUD housing and credit counseling agency, is the initial HUD counseling agency of HomePrep.

How HomePrep Works

See a visual that shows the process of a client that starts through HomePrep. Follow their path from a realtor referral to the MLO... to a HUD housing counselor... all the way through the client closing on a home!

Russell Graves explains 6 HomePrep services

Russell Graves, HUD Counseling Agency (HCA) NFDM.org Exec. Dir., HUD certified housing counselor, and past loan originator, explains 6 specific services of HomePrep, the technlogy platform that connects mortgage loan originators with clients seeking mortgage-readiness to HUD housing and credit counselors who can get them ready.

6 Client Services Offered by HUD Counselors through HomePrep

MLO's and HUD Counselors worked hand in hand to discover the top issues that prevent clients from getting a mortgage. Then they found the services that could fix them. Those issues and vetted services became the model for the HomePrep technology platform and are listed below.

1.Credit

Both short term (1-6 mos) and long term (7mos to 5 yrs) credit help using CreditXpert tools and more.

2.DPA Availability

Down payment assistance available in all 50 states by 1)utilizing HUD Counselors...

or 2)MLOs can get DPA info directly through Down Payment Connect.

3.Student Loan Repayment

Student loan repayment plans through Student Debt Solutions (SDS), whether for purchasing a home or just needed individually. No cost to check repayment plans available

4.Homebuyer Education

Homebuyer education needed for down payment assistance and specific grants.

5.Budgeting for a Home

A family budget allows you to see how much money you have, how much money you have left over, and how much you can put towards a mortgage.

6.Freddie Mac HomeCoach

For HUD counselors to use, works with a soft credit pull, and for conventional Affordable mortgages.

Client Cost to Use HomePrep

Standard NFDM HUD Counseling Service Costs:

- $99 fee for HomePrep Services (paid by client)

- $99 credited back to client at the completion of HomePrep

SDS Student Loan Repayment Plan cost:

- Client only pays if they proceed with a repayment plan.

- Basic: $29 for forms and instructions.

- Standard: $49 for document preparation tools.

- Additional cost to talk with live with expert student loan counselor.

- SDS cost is additional to Standard NFDM HUD Counseling Service Costs.

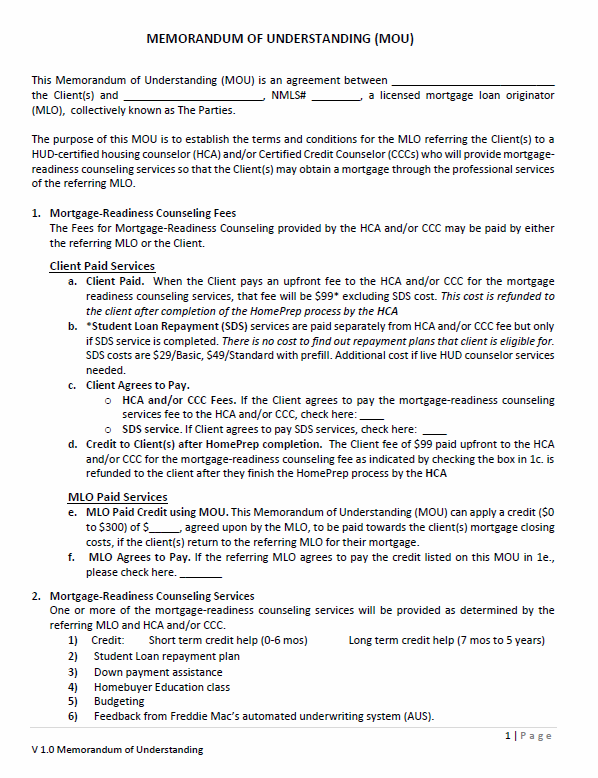

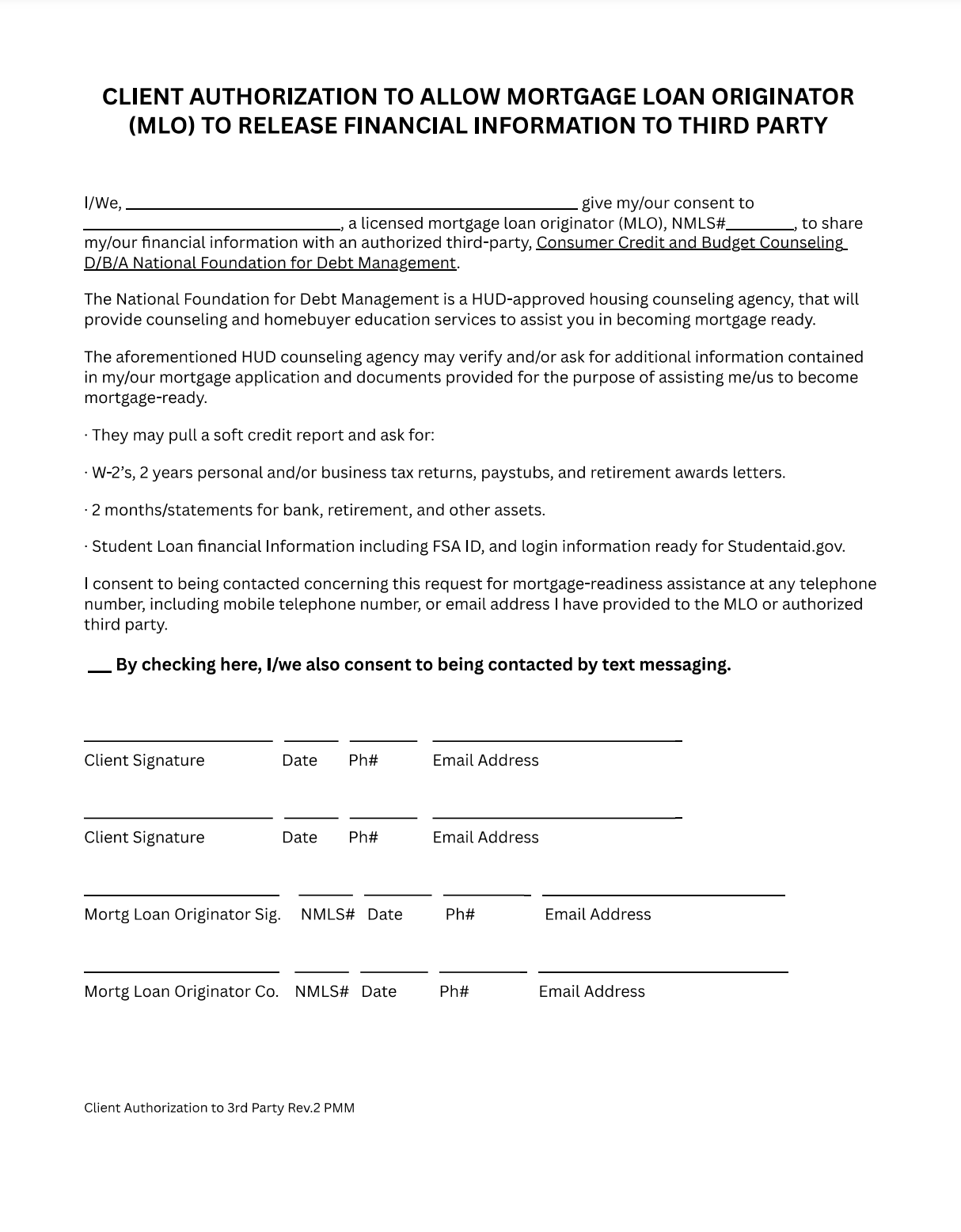

Documents that loan originators and their clients will need to review and sign for HomePrep.

Under the guidance of the National Foundation for Debt Management, clients receive tailored support to become 'mortgage ready.' Essential to this process are two key documents: a Client Authorization for Information Release and a Memorandum of Understanding, both requiring signatures from the client and mortgage loan originator (MLO) for portal upload.

What's in the Memorandum of Understanding (MOU)?

The MOU signed by the MLO and their client shows:

1)costs paid upfront by the client for HUD counseling services

2)loan originator costs paid to use the HomePrep portal

3)a credit ($0-$300)that can come from the loan originator and be applied towards closing costs services rendered, if the client returns to the loan originator for their mortgage.

Both the MLO and client sign the 2 documents that can be downloaded on the right:

- Client Authoriz. to Allow the MLO to Release Financial Info to 3rd Party

- Memorandum of Understanding (MOU)

HomePrep Testimonial

My wife and I met with Matthew with National Foundation for Debt Management (NFDM.org) on Thursdays once a week like clockwork. We would learn in detail how to fix our credit. He would set attainable goals that you can reach and feel better about yourself that you are accomplishing something even if it's small. We learned everything has a positive outcome with Matthew. He paid so much attention to detail and you felt you were really listened to and valued and never judged… your question was answered with respect. Matthew helped us achieve our life goal at 50 years old of owning a home for the first time in our lives.

Please tell Mathew we miss him and without him, none of this would ever have been possible.

- Chris and Valorie, clients of HomePrep

Prospective homeowners, do you need help becoming mortgage ready? Let your loan Originator know, or contact Russell Graves, Exec. Dir. of National Foundation of Debt Management at rgraves@nfdm.org or 727-755-8558 to find out more about HomePrep!

HomePrep is the MLO resource to get clients with issues that need to be fixed connected to HUD counselors who can get them mortgage-ready.