Equal Housing Lender

Neighborhood Home Solutions said it best… “If we don’t watch what we eat and don’t exercise we become unhealthy, often overweight and are more susceptible to disease. Right? Well, think about your finances. If you’re not taking care of how and where you spend your money your financial health is at great risk!”

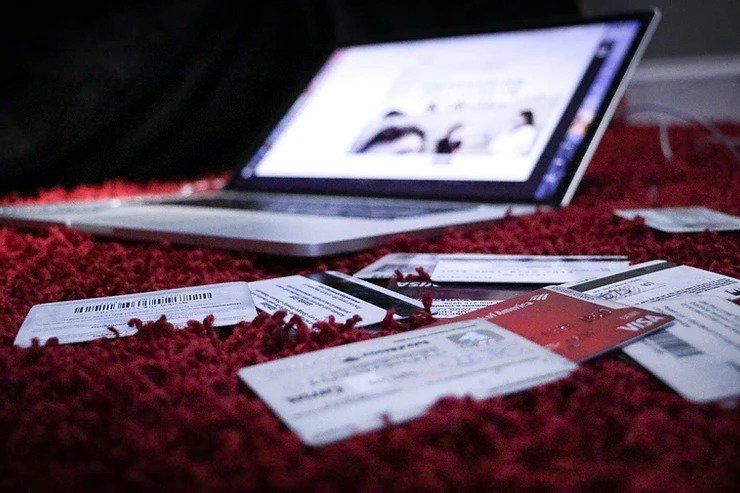

Clients2Homeowners couldn’t agree more.Our goal is to help you achieve homeownership by improving your financial health. We support you in correcting your credit, improving your credit scores and building your credit. We also assist you with down payment assistance where available and are always looking for more resources. Home budgeting is critical especially now with layoffs, cutbacks of hours and new employment options.

We will introduce you to specific credit tools such as CreditXpert, Wayfinder, and What If Simulator. We will let you know about available down payment assistance programs and new mortgage programs. Best of all, with Clients2Homeowners you have an advocate on your side, and an experienced mortgage professional that can answer your questions to prepare you for homeownership.