The mortgage industry is poised for a potential uptick in production due to a long-awaited reduction in interest rates. This presents a valuable opportunity for mortgage professionals to help clients, especially those burdened with student loans, to secure favorable mortgage terms. To fully capitalize on this, it’s crucial for loan originators to focus on three key areas: the impact of credit report changes after September 30, 2024, the benefits still available for federal student loans, and knowing the differences between federal and private loans. An example of a self-service student loan analysis tool that can be used for FREE can be found in this article.

When to use MLO DIY Solutions

•1 or 2 DIY services for client needed.

•Short term remedy.

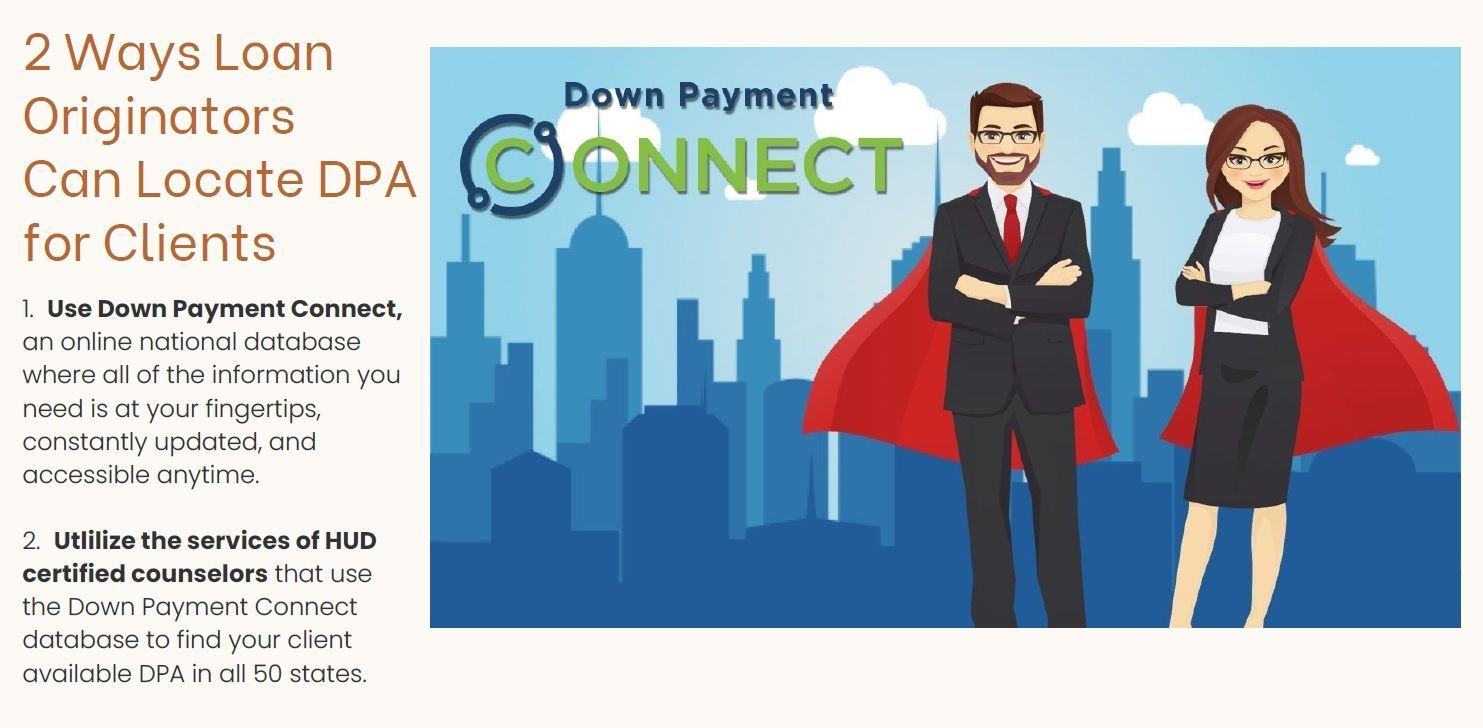

•MLO will need to know how to refer or use services. Some services are subscription based like CreditXpert and Down Payment Connect.

•If there is cost, this is noted on service page.

1. How MLO starts referral to HomePrep...

•MLO is too busy or prefers professional get client mortgage ready.

•MLO does HomePrep demo and signs up, refers clients. MLO pays $100/yr. through invoice.

•MLO completes Memo of Understanding. Provides credit of $0-$300 towards clients' clos. costs if client returns to MLO for mortgage.

2. HUD Counselor will...

•review MLO needs for client.

•provide Action Plan with est. time client will be mortgage-ready. •communicate with client and MLO 1-2 times/mo.

•receive $99 to HomePrep but will provide $99 credit if HomePrep completed.

•stay in touch with referral partner on client progress.

3. Client is ready! MLO notified!

•HUD counselor final step: run client through FHLMC AUS w/soft credit for approval. Confirms approval & no unknown credit.

•MLO notified client is mortgage ready.

•Client is reminded that referring MLO will provide credit of $0-$300 towards clients' clos. costs.

•MLO lets referring partner know client is ready to purchase a home!

2 Paths of Services for MLOs and Their Clients

Path 1: MLO DIY (Do It Yourself) Solutions and Path 2: Refer Client to HomePrep with HUD Counselor

The Best Resources For MLOs Assembled

MLO DIY Solutions

"How To" resources for MLOs that want to learn how to use tools that can expand education of challenges and how your client can overcome them.

Some services are FREE but some are at a cost to the MLO or your client.

Costs are noted on services Home, MLO DIY Solutions and HomePrep for MLOs pages.

HomePrep for MLOs

MLOs refer challenged clients to HUD counselors to correct issues. When the client is "mortgage ready", the MLO is notified!

There is a cost to use HomePrep for the MLO. Some services have a cost for your client.

For more about HomePrep for MLO's, go

here.

Other Resources

Articles, mortgage trade groups, mortgage advocacy, tips from industry professionals and more!

For more Resources, go here!

Disclaimer : Pamela Marron, licensed loan originator NMLS# 246438 and developer of Clients2homeowners.com, receives no compensation for any services shown on this website. This website was made for mortgage loan originators to assist clients who have challenges getting a mortgage.