Equal Housing Lender

Loan Originators Should Consider Targeting Specific Mortgage Products That Are Still Being Sought By Prospective Homebuyers. The NEED is There.

Mortgage headlines are now projecting two more years of a downturn in the housing market, but this is the time loan originators need to laser focus on a client NEED market and learn about recent mortgage products that are gaining traction. Fannie Mae and Freddie Mac Affordable products specifically benefit 80% of area median income (AMI) clients.

You may be surprised at the income levels in your area. Unique mortgage products such as Freddie Mac’s 95% LTV on owner-occupied 2-4 unit properties, manufactured home financing, renovation loans, and a newer mortgage product for Accessory Dwelling Units (ADU), where space can be added to a home to offer independent living to family members or for rental income are all available now. The FHA 203H, 100% financing available in designated disaster areas, the NEED for down payment assistance (DPA) which is elevating, and credit tools for loan originators to prepare clients with the best credit scores are also available.

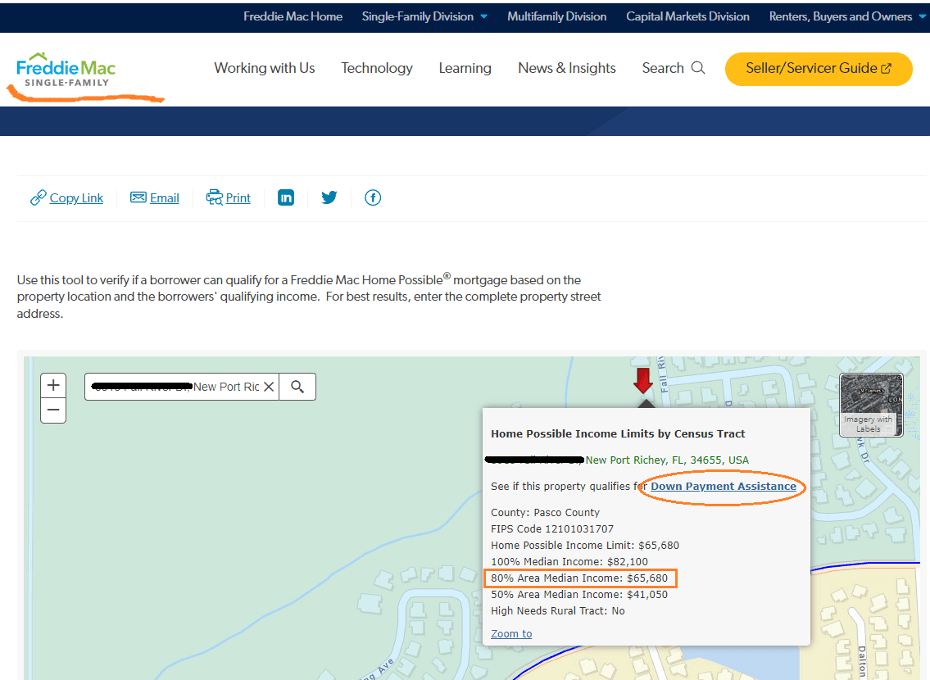

Fannie Mae[1] and Freddie Mac[2] have been aggressively promoting refinance and purchase of Affordable mortgage loans that are available for clients with an income up to 80% area median income (AMI). The Freddie Mac tool even has a link to Downpaymentresource.com to show what down payment assistance can be found in a specific address area.

For both Fannie Mae and Freddie Mac, the maximum income can be for one borrower or both in the household to qualify. At 80% AMI, 97% financing is available with reduced PMI rates that get better with higher credit scores. The array of

Fannie Mae products NEEDED now can be found here and the array of

NEEDED Freddie Mac products are here. Freddie Mac is even offering up to $2500 for eligible clients through their

BorrowSmart program at pilot mortgage companies and with an additional $7500 for clients in an eligible minority census tract in Baltimore, Chicago, and Detroit.

Maximum 95%LTV financing for owner-occupied 2-4 unit properties is available through Freddie Mac.

Accessory Dwelling Unit (ADU) refinance and purchase mortgages that allow adding on space to offer an independent living area to family members or to gain residual income by renting out the unit and are available through both Fannie Mae and Freddie Mac. ADU NEED is growing, and municipalities are adopting changes to existing building codes to make way for this option.

Down payment assistance (DPA) has been elevated to a top spot of the NEED list for prospective homebuyers. Downpaymentresource.com, a national data resource for DPA, includes wholesaler DPA resources available to mortgage brokers nationally. DPA clients can connect with mortgage professionals through Down Payment Connect. Tip: loan originators need to be focused on details of the DPA 2nd mortgage to ensure a good match with the first mortgage.

The FHA 203H program through the Federal Housing Administration (FHA) allows 100% mortgage financing from qualified lenders to victims of a major disaster who have lost their homes and are in the process of rebuilding or buying another home. This program is a big help for Florida after hurricane Ian.

Getting your clients the best credit score for the best mortgage products and lowest PMI is key now more than ever and can be done through CreditXpert products such as the What-If Simulator and Wayfinder. These products are available to loan originators through your credit reporting agency and can be used on soft and hard credit pulls. Credit score increases can be applied quickly through a paid Rapid Rescore but loan originators need to pay for this. Or, the client can do the steps needed and wait 30 to 45 days before seeing the changes applied to a new credit report.

Tip: When you see disputes on a credit report, go to What-If Simulator to find out what deleting this account will do to the credit score ahead of time. Deleting the dispute is often a requirement found in Fannie Mae and Freddie Mac's findings.

Freddie Mac Income and Property Eligibility Tool

Finally, don’t forget that some of your clients may be eligible for the student loan forgiveness funds and this may make them eligible for a home purchase. This gives you an opportunity to solicit both prospects and past borrowers and let them know that they or others they know may now be eligible for a mortgage.

There are many areas where mortgages can be made. Learn what clients in your area NEED and then get those tools. Home prices are becoming slightly more affordable. Be ready for the NEED of your clients by educating yourself now.

We are looking for up to 10 licensed mortgage loan originators to be part of this pilot. You can be new or experienced. Call Pam Marron at 727-534-3445, email pam.m.marron@gmail.com or use the form below to be considered for the pilot.

Stay tuned.

[1] Fannie Mae Area Median Income Lookup: https://ami-lookup-tool.fanniemae.com/amilookuptool/

[2] Freddie Mac Income and Property Eligibility Tool:

https://sf.freddiemac.com/working-with-us/affordable-lending/home-possible-eligibility-map

Pilot Program Inquiry

Writer Pamela Marron is a licensed Loan Originator NMLS #246438 in Florida who works for Innovative Mortgage Services, NMLS #250769 in Lutz, Fl. Articles written are strictly her opinion and are published to help loan originators, real estate professionals and mortgage clients. This is not used to solicit for business.

Pam Marron | NMLS# 246438

Tara Jerse | NMLS# 2105127

Innovative Mortgage Services, Inc. | NMLS# 250769

Equal Housing Lender